- Accounting, AI, Finance, Sage Intacct

In today’s fast-paced business environment, organisations are constantly seeking ways to improve operational efficiency and drive growth. One area where technology is making a significant impact is in accounting and finance. Sage has been at the forefront of this transformation, leveraging the power of artificial intelligence (AI) to revolutionise how businesses manage their finances.

At Sage Transform 2024, Sage unveiled Sage Copilot, an AI-powered productivity assistant designed to automate workflows, manage cash flow, and generate and send invoices with simple, natural language commands. Sage Copilot acts as a trusted partner, handling administrative tasks, identifying errors, and providing actionable insights in real-time. This innovative tool enables businesses to improve efficiency, reduce manual errors, and drive growth.

In this blog, we explore the transformative impact of AI on accounting and finance, focusing on Sage Intacct’s innovative AI-powered solutions.

Enhancements to Sage Intacct

The latest enhancements to Sage Intacct promise to streamline operations and boost productivity for businesses. AI-powered project and resource management provide greater visibility into resourcing and help keep projects on time. Additionally, forms and operational flows have been improved to help businesses work better and get more done. These enhancements are designed to optimise and automate project management tasks, allowing businesses to focus on their core competencies.

Sage Intacct with AWS for Modern Finance

Sage partnered with Amazon Web Services (AWS) to enhance how small and medium-sized businesses (SMBs) optimise their operations with generative AI. This collaboration will inform Sage Copilot and serve as a foundation for SMBs to navigate local accounting and compliance applications. The agreement not only enables SMBs to leverage Sage Intacct in the AWS Marketplace but also helps them navigate the complexities of modern finance and address environmental responsibilities with cutting-edge solutions.

The Advantages of AI for Finance Teams

For Sage Intacct users, AI offers a range of specific benefits tailored to finance departments. These include the following:

• Simplified Automation: Sage Intacct leverages AI for automated financial tasks like invoice processing and expense management, reducing errors and improving efficiency;

• Insightful Analytics: AI-powered analytics in Sage Intacct offer actionable insights into financial performance and trends, aiding in informed decision-making;

• Proactive Forecasting: Sage Intacct’s AI capabilities enable predictive analytics for forecasting financial outcomes and identifying risks and opportunities;

• Tailored Reporting: AI-driven reporting tools in Sage Intacct allow for quick and accurate generation of customisable financial reports, aiding in timely analysis;

• Fraud Prevention: Sage Intacct’s AI algorithms detect anomalies in financial data, aiding in the detection and mitigation of fraud risks;

• Personalised Recommendations: AI algorithms analyse customer and transaction data in Sage Intacct to offer personalised financial recommendations;

• Compliance Support: Sage Intacct automates compliance checks and reporting processes, ensuring adherence to accounting standards and regulations;

• Cost Efficiency: Sage Intacct helps identify cost-saving opportunities and optimise resource allocation for improved profitability;

• Streamlined Workflows: AI-driven workflows in Sage Intacct automate approval processes, reducing manual effort and accelerating financial transactions;

• Scalability and Flexibility: Sage Intacct’s cloud-based platform with AI capabilities enables seamless scaling and adaptation to changing business requirements.

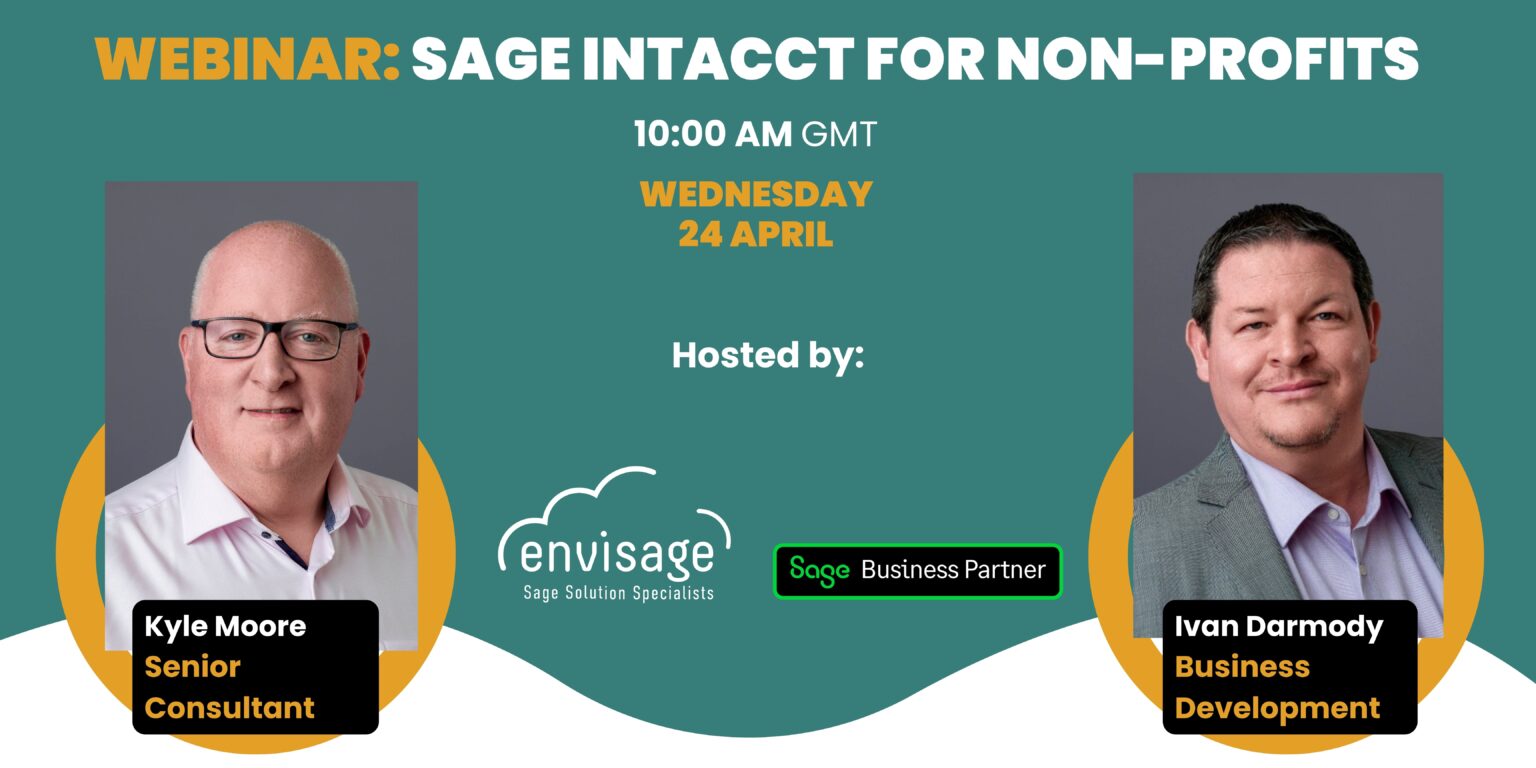

Transform Your Finance Team with Envisage

Sage Intacct’s AI-powered solutions are transforming the accounting and finance landscape, enabling businesses to improve efficiency, reduce errors, and drive growth. With Sage Copilot and the latest enhancements, businesses can streamline operations, boost productivity, and make smarter decisions.

Envisage has a skilled Sage technical team in Ireland, specialising in implementation, support, and development. Contact us if you’re thinking about upgrading your accounting software to streamline operations for your finance teams. Our experts can simplify the process of upgrading your current software and integrating Sage Intacct.

About the Author

David Burke

David Burke, the Technical Director for Envisage, is responsible for developing bespoke and off-the-shelf solutions, including easyDD for Sage. In 2023, he achieved accreditation as a Sage Intacct Implementation Certified Consultant.